The letter below was sent to the Arbitral Tribunal in PCA Case No. 2023-69 and the World Bank, demonstrating with evidence that the rendered award is fundamentally flawed, egregiously misinterprets New York law, and is tainted by clear and manifest bias. The award appears to have been issued with the singular objective of safeguarding the World Bank’s interests. The serious concerns outlined cast doubt on the integrity of this arbitration and raise significant questions about the credibility of any future arbitrations involving the World Bank.

Despite grave allegations of a miscarriage of justice and favouring the World Bank in contravention of both the law and the merits of the case – alleging that the award is patently corrupt – the Tribunal has not responded, seemingly due to its inability to refute the accuracy of the allegations and statements contained in the letter below.

UNICON believes that Mr Grant Hanessian dissented from the majority regarding the award. It is UNICON’s understanding that, driven by his high regard for justice, Mr Hanessian chose to withdraw his dissent in order to include an order requiring the World Bank to bear its full legal costs and to contribute 50% towards the Tribunal’s costs. UNICON believes that Mr Hanessian’s decision was guided by his ethical commitment to preventing an improper order whereby an innocent party [Unicon] would otherwise be compelled to remunerate a wrongdoer [World Bank]. UNICON wishes to express its utmost respect for Mr Hanessian’s dedication to justice and fairness, and to ensure that no undeserved shadow is cast upon him.

_____________________

To: Arbitral Tribunal in PCA Case No. 2023-69 (Unicon Ltd. v. The World Bank)

- Catherine Amirfar (Debevoise & Plimpton LLP)

- William Kirtley (Aceris Law LLC)

- Grant Hanessian (Hanessian ADR, LLC)

Re: Questioning the Integrity and Legitimacy of the Arbitral Award in PCA Case No. 2023-69

Dear Arbitrators,

1. On April 19, 2024, the tribunal rendered its Award in PCA Case No. 2023-69 brought by Unicon Ltd. (“UNICON” / the “Claimant”) against the World Bank (“IBRD” / the “Respondent”) for breach of contract. Specifically, the tribunal delivered its judgment on the bifurcated matter “whether the World Bank breached Article 25.03 of the Contract by its conduct.” New York law governed the contract and the seat of arbitration was Washington D.C. The tribunal concluded that the World Bank did not breach Article 25.03 without providing adequate explanation.

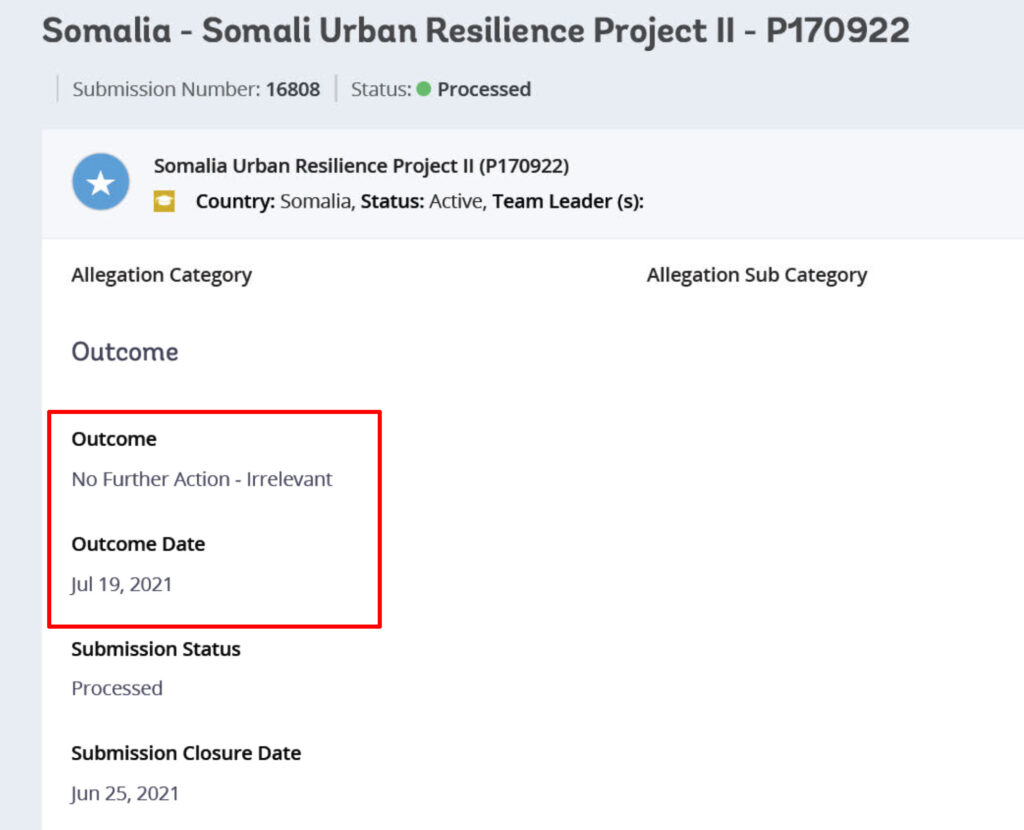

2. On July 19, 2024, with the expiration of the three-month deadline to file a motion to vacate the Award under the Federal Arbitration Act (FAA), and observing that no such motion was filed, the World Bank acted against UNICON and sanctioned it based on the tribunal’s Award, which legitimised the World Bank’s unlawful actions. Under such circumstances, the credibility of the Award and its justification becomes central to justifying the destruction of a viable entity with a 20-year legacy.

3. Separately, on July 4, 2024, UNICON informed the World Bank that it would not allow insinuations to stand and would continue its pursuit for truth. Subsequently, UNICON approached state authorities in Somalia on July 29, 2024, demanding a proper investigation.

4. Despite the tribunal’s order to maintain total confidentiality, UNICON never agreed with such an order and considered it a breach of the arbitration agreement. Public interest demands full disclosure of this matter as the World Bank provides billions of dollars in contracts annually, and the industry must be fully aware of how the World Bank (mis)interprets contract provisions it drafts and imposes upon contractors.

5. For the compelling reasons detailed in this letter, summarising the arbitral pleadings, UNICON asserts that the Award is fundamentally defective, misapplied New York law, and is the result of blatant prejudice and an overt intention to protect the interests of the World Bank, irrespective of the law and the facts.

A. Substance of Dispute and Contract’s Article 25 (Audit)

6. The crux of the dispute was the interpretation of the Contract’s Article 25 (Audit), specifically the application of its first two (of three) audit limitations spelled out in Article 25.03, which reads:

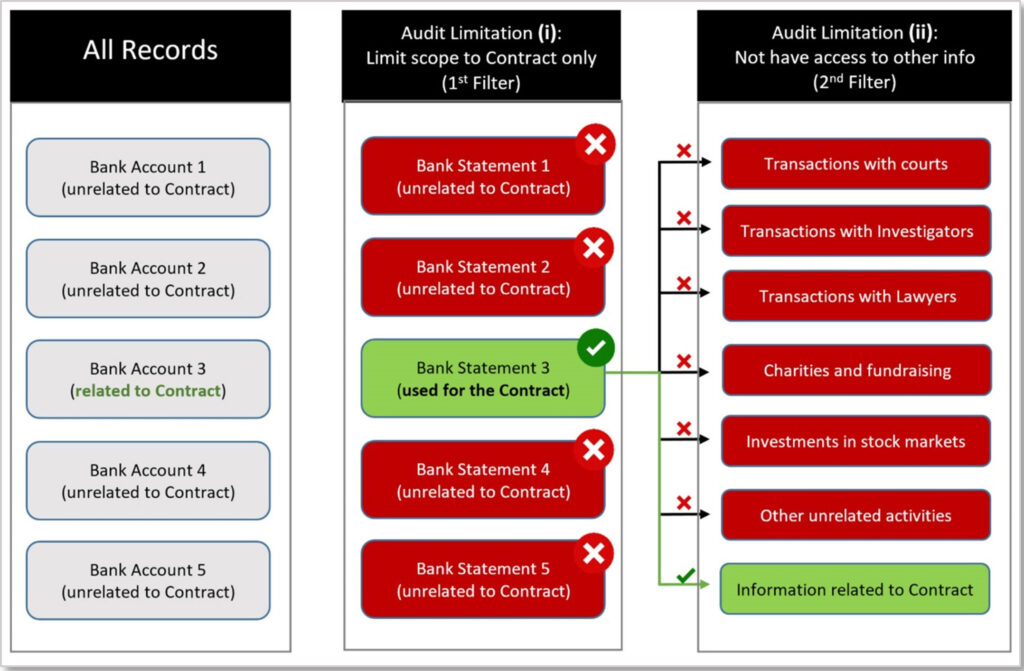

25.03 Contractor shall make its Records available at its office for examination, audit, or reproduction by Purchaser or Purchaser’s designated representative, at all reasonable times until the expiration of five (5) years after the date of final payment under the Contract, or for such shorter or longer period, if any, as is required by other Articles of this Contract. Purchaser shall have the right to examine and audit all Records and other evidence sufficient to validate that all amounts invoiced under this Contract comply with the terms of the Contract. Purchaser will: (i) limit the scope of its audit and examination only to the Contract, (ii) not have access to any other Contractor’s information, and (iii) ensure that both itself or its designated representatives will fully comply with Confidentiality and Data Privacy provisions set out in this Contract.” (see C-002, pages 7-8)

7. Article 25 is a detailed provision based on a logical algorithm of rights and obligations. The key takeaways are as follows:

- Definition of “Records” is broad and without limitations (Art. 25.01)

- “Contractor shall make its Records available at its office for examination, audit, or reproduction by Purchaser” (Art. 25.03)

- Audit “to validate that all amounts invoiced under this Contract comply with the terms” (Art. 25.03)

- The World Bank will: “(i) limit the scope of its audit and examination only to the Contract” (Art. 25.03)

- The World Bank will: “(ii) not have access to any other Contractor’s information” (Art. 25.03)

- In case audit determines “overpayment,” deduct the amount of such overpayment or demand reimbursement (Art. 25.04)

8. When the World Bank initiated the audit, UNICON provided the requested data. Following Audit Limitation Number (ii) (item ‘e’ above), UNICON redacted transactions from bank statements that constituted “other information” unrelated to the contract. This redaction led to a dispute, arbitration, and eventual sanction, which was anticipated to be a central issue in the Award. However, this matter was not addressed in the Award at all.

B. The World Bank’s Request for Information in Breach of Audit Limitation (ii)

9. The World Bank requested UNICON to provide all information without limitations, including “other information,” or face sanction for alleged non-compliance with contract’s audit provisions:

The World Bank to UNICON:

we need to assess the completeness of the information provided to [World Bank]. This involves [1] selecting a sample of transactions from the complete, detailed bank statements and accounting records, [2] requesting supporting documents for these transactions and, [3] based on the review of the supporting documentation, determining whether or not they are [Contract] related. To facilitate this, INT requests the complete set of unredacted bank statements […]

Audit has enabled [the World Bank] to: (i) understand and document the source of provided information; (ii) test, verify and analyze any and all transactions and records that INT deems relevant” (see C-042, pages 2-3)

failure to respond meaningfully to [the World Bank’s] request for information under the Bank’s inspection and audit rights provided under its vendor contract with UNICON on the Somalia project could constitute an obstructive practice as defined under the Bank’s Corporate Procurement Vendor Guide and Vendor Eligibility Policy” (see C-042, page 1)

10. The sanction imposed on UNICON, for its adherence to the contract’s audit limitations, was justified by the World Bank as follows:

Without a full and comprehensive set of unredacted bank statements, INT is unable to conduct a complete assessment […] It is important to note that INT is entitled to conduct the audit with respect to the Contract pursuant to the General Terms. […] UNICON engaged in a sanctionable practice under the Policy by deliberately refusing to provide requested information necessary to allow INT to conduct a full and complete audit and inspection of UNICON’s books and records, thereby materially impeding the exercise of the Bank’s inspection and audit rights as provided for under the Policy and the General Terms.” (see C-006, page 4, ¶¶ 5(k) – 7)

C. UNICON’s Interpretation of Audit Rights and Limitations in the Arbitral Record

11. Under New York law, it is paramount to establish the Parties’ intent and understanding of the terms when construing the contract. UNICON provided a detailed explanation of its understanding of the audit provisions and how it understood the two material audit limitations (number (i) and (ii)), summarised as follows:

where:

- “Records” refers to all data sources without limitations;

- Audit Limitation (i) narrows down the audit only to the Records that are related to the Contract; and

- Audit Limitation (ii) further narrows down the audit to the information within such Records only related to the Contract and explicitly prohibits the World Bank from accessing any “other information” within such Records.

12. The above understanding is also supported by the provision that audit must be conducted only “at [UNICON’s] office” (Art. 25.03), highlighting that the World Bank must filter information subject to audit prior to any reproduction to avoid incidental “access to other information.” This provision supports an understanding that auditors may look at all transactions in the bank statements during an office visit but cannot reproduce transactions not related to the contract under Audit Limitation (ii). The demands of the World Bank for electronic supply of all data sets without limitations were clear in its communication (see above, ¶ 9).

13. Audit Limitation (iii) protects data supplied to the World Bank under the audit that met the criteria of Limitations (i) and (ii). This was not a matter of dispute.

D. World Bank’s Interpretation of Audit Rights and Limitations in the Arbitral Record

14. The World Bank deliberately avoided providing its interpretation of audit limitations that it drafted. As the Award pointed out, the World Bank recognised only one of the two key audit limitations:

Award: “Respondent [i.e., World Bank] emphasizes that Article 25.03, when read with Article 25.01 and the GTC as a whole, provides Respondent with broad audit rights subject to only two express limitations: (i) the scope of any audit must be limited to the Contract, and (ii) [must be (iii)] Respondent must comply with the Confidentiality and Data Privacy provisions of the Contract” (see Award, page 24, ¶ 76)

15. The World Bank did not recognise the existence of the second audit limitation (“(ii) not have access to any other Contractor’s information”) – the sole cause of the dispute and arbitration. In its pleadings, the World Bank made it clear that it only accepts Audit Limitation Number (i):

broad rights to audit all Unicon’s ‘Records’ as that term is defined in the Contract, with the only relevant limitation being that those Records be related to the Contract.” (see Respondent’s Second Round, page 4 in pdf file, ¶ 3)

The plain language of the third sentence of Article 25.03 clearly provides the only relevant limitation on IBRD’s rights to audit and examine Unicon’s records: they must be related to the Contract. There is no further limitation.” (see Respondent’s Second Round, page 13 in pdf file, ¶ 23)

16. UNICON complained about this approach before the Award was issued, but it was ignored:

The audit’s scope limited to the Contract spelled out in (i) sets limitation on records to be relevant to the Contract only. Thus, (ii) cannot be a repetitive limitation of (i) and it carries a different meaning. The term “information” is not specifically defined and the Respondent [World Bank] agreed that bank statements may contain “other information” (Second Round, ¶ 25).

With Respondent’s intent absent on record, we are guessing what it might have meant with two separate limitations.” (see Claimant’s Submission on Costs (with complaint), page 2)

17. The Award mirrored the World Bank’s position and ignored the existence of Audit Limitation (ii), which was the crux of this arbitration. The Award appears reasonable only if Audit Limitation (ii) is deleted. It is unclear what empowered the tribunal to do that.

E. Both Parties Agreed to Definition of “Other Information” in Audit Limitation (ii)

18. The Parties agreed that the term “other information” in Article 25.03’s Audit Limitation (ii) includes any and all bank transactions not related to the Contract. In the World Bank’s own words:

World Bank: “Although Unicon asserts that bank statements would necessarily contain ‘all other information beyond and unrelated to this Contract’ and ‘the entire life of the firm,’ [the World Bank’s] audit request concerned only ‘bank accounts used for depositing receipts or making disbursements relating to the Bids and the Contracts.’ Other information would thus be present on these Records only if Unicon itself decided to combine its projects together into a single bank account. Unicon cannot rely on its own record-keeping practices – which were entirely under its own control – as an excuse to assert redaction rights that would effectively defeat IBRD’s audit rights.” (see Respondent’s Second Round, pages 13-14 in pdf file, ¶ 25)

19. The difference between the Parties was that (1) the World Bank blamed UNICON for including “other information”/transactions in the same bank account with transactions related to the Contract, whereas (2) UNICON claimed that nothing suggested the need to open separate bank accounts for every new micro-contract and the World Bank’s suggestion is both illogical and impossible to implement, as no commercial bank would allow opening separate accounts for each micro-contract signed – this applies to all vendors globally. Neither did the World Bank suggest in any form that it expected a new separate bank account to be opened.

20. Both Parties also agreed during arbitration that access to “other information” contained in unredacted bank statements constitutes a breach of Article 25.03. In the World Bank’s own words:

World Bank: “IBRD [i.e., the World Bank] could have breached Article 25.03 only by actually conducting a formal examination of the unredacted bank statements. It is undisputed that IBRD has not done so because Unicon never provided them, and IBRD can therefore not have breached Article 25.03.” (see Respondent’s Second Round, page 17 in pdf file, ¶ 34)

F. Tribunal’s Questionable Logic Leading to Award

21. Co-Arbitrator William Kirtley’s single question at the hearing was:

I was wondering something of Claimant, whether it agrees with the Respondent that Records as defined in GTC Article 25.01 include banking statements?” (see Transcript, from page 54 (line 25) to page 55 (lines 1-3))

22. This question may suggest Mr Kirtley did not adequately review UNICON’s pleadings. UNICON’s position on this matter was clearly articulated in both rounds of written submissions:

Unicon in First Round: “Bank statements are Records, as defined in Article GTC 25.01.” (see Claimant’s First Round, page 17, ¶ 32)

Unicon in Second Round: “even if Records were to stand for unlimited full bank statements, […] material provision of Article GTC 25.03 obliges that the Respondent must “not have access to any other Contractor’s information” compelling the Claimant to redact those parts of Records/bank statements that are not related to the Contract” (see Claimant’s Second Round, page 17, ¶ 36 (also in ¶¶ 31, 43))

23. The issue was not whether “bank statements” are “Records” pursuant to Article 25.01, but how two explicit audit limitations in Article 25.03 influenced the degree of disclosure. It appears Co-Arbitrator Kirtley focused solely on the definition of Records in Article 25.01, ignoring the limitations designed to protect unrelated other information within the Records.

24. Co-Arbitrator Catherine Amirfar’s single question at the hearing was:

Is it the case that the full sum of the audit rights for purposes of adhering to the vendor policy would have to be captured in some form in the GTC or the vendor contract itself; in other words, the audit rights don’t emanate from the Vendor Eligibility Policy but rather need to emanate from the underlying vendor contract; is that correct that understanding?” (see Transcript, from page 55 (line 25) to page 56 (lines 1-7))

25. This question suggested that the Vendor Eligibility Policy’s goals allegedly supersede the contractual provisions. In other words, if the contract’s audit provision contains limitations that may be perceived as obstacles for determinations under the Policy, then such contractual provisions are voided.

26. UNICON provided the tribunal with evidence on September 29, 2023, that the World Bank is not limited to contractual audit rights for investigations and can engage state law enforcement bodies to assist in areas where contractual rights are limited:

Page 4: “[World Bank’s] INT contacted the Royal Canadian Mounted Police (“RCMP”) in March 2011 and shared the tipsters’ emails, investigative reports, and other documents, the RCMP sought and obtained three wiretap authorizations to intercept private communications pursuant to Part VI of the Criminal Code”

27. Clearly, the above actions are not part of contractual rights. The tribunal was also aware that UNICON offered the World Bank to engage law enforcement on May 26, 2023, for proper investigation with unlimited access to any data – an offer that the World Bank rejected:

Unicon welcomes and urges referral of INT’s case to state law enforcement agencies as it wishes for these allegations to be assessed in the public domain by state authorities as Unicon has nothing to hide or be afraid of” (see C-007, pages 2-3)

28. There is no basis to speculate if the Policy can re-write clear contractual provisions. The World Bank has other tools for investigations outside the contractual scope, and the tribunal was aware of this.

G. Tribunal Ignored Key Evidence of Unfounded Audit

29. The World Bank’s Exhibit R-002 incidentally revealed that the allegation against UNICON was unfounded and that the Bank was misleading the tribunal by creating a knowingly false image of UNICON. When this was exposed, [see Claimant’s Comments to Exhibit R-002] the World Bank requested UNICON three times to cancel the hearing, albeit unsuccessfully. On February 12, 2024, during a call preceding the hearing, the World Bank attempted to exclude R-002 from the hearing out of fear:

Let’s say if the tribunal has any questions about those exhibits, let’s say if the tribunal wanted to know who works at the internal form [R-002] when it comes up in the system and how do you determine if there is already an active case

30. But the tribunal had no intention of questioning any of the World Bank’s (mis)conduct. This was material because Exhibit R-002 (page 3) and UNICON’s Comments on it revealed that all of the ‘corruption’ claims and statements made by the World Bank were false and misleading:

H. Award’s Unlawful Conclusion – No Limitations in Audit

31. The tribunal terminated the proceedings citing UNICON’s position [see Award, pages 28-29, ¶ 96] made during the hearing that the proceedings shall be terminated only if the tribunal finds that the World Bank “had the rights to all unredacted bank statements, whether related or unrelated to the contract.” [see Transcript, page 58, lines 14-22] The tribunal terminated proceedings on this basis, i.e., that the World Bank has the right to access any other information “related or unrelated to the contract.”

I. New York Law as Pleaded by the Parties

32. The following references to New York law were cited by the Parties for construing the contract:

Words and phrases used by the parties must, as in all cases involving contract interpretation, be given their plain meaning […] the best evidence of what parties to a written agreement intend is what they say in their writing … a written agreement that is complete, clear and unambiguous on its face must be enforced according to the plain meaning of its terms” (RL-009, CL-10)

“Courts must construe contracts in a manner which gives effect to each and every part, so as not to render any provision meaningless or without force or effect” (RL-012)

“A court may not rewrite into a contract conditions the parties did not insert by adding or excising terms under the guise of construction, nor may it construe the language in such a way as would distort the contract’s apparent meaning.” (CL-08)

“Where parties have conflicting understandings of a term, the contract is given ‘the meaning of the party who is unaware of the ambiguity if the other party knows or has reason to know of the ambiguity’” (RL-009)

“Where the parties have attached different meanings to a promise or agreement or a term thereof, it is interpreted in accordance with the meaning attached by one of them if at the time the agreement was made – that party had no reason to know of any different meaning attached by the other, and the other had reason to know the meaning attached by the first party.” (RL-009)

“When the parties attach different meanings to words in the agreement, and the first party neither knew nor should have known of the meaning attached by the second party, and the second party knew or should have been aware of the meaning attached by the first party, there is a contract according to the intention of the innocent first party” (RL-009)

“A promise is a manifestation of intention to act or refrain from acting in a specified way, so made as to justify a promisee in understanding that a commitment has been made […] The phrase ‘manifestation of intention’ adopts an external or objective standard for interpreting conduct; it means the external expression of intention as distinguished from undisclosed intention. A promisor manifests an intention if he believes or has reason to believe that the promisee will infer that intention from his words or conduct.” (CL-06)

“There can be no doubt that if [Party A] had intended a more specific, limited, or narrower meaning for the terms used, then the burden was upon him, as drafter of the contract, to so specify, and his failure to do so must not operate to the [Party B]’s detriment” (CL-08)

“Agreement is unambiguous if the language it uses has ‘a definite and precise meaning, unattended by danger of misconception and concerning which there is no reasonable basis for a difference of opinion’” (CL-10)

“In cases of doubt or ambiguity, a contract must be construed most strongly against the party who prepared it, and favorably to a party who had no voice in the selection of its language (CL-04)

J. Questioning the Award’s Credibility and Integrity

33. The Award may seem reasonable only to those unfamiliar with the details. It is intentionally structured to mislead, obscuring the complete lack of analysis on Audit Limitation (ii) – the central issue of the arbitration. A breakdown of the Award’s deceptive narrative is available.

34. Given the overwhelming evidence detailed in this letter, based on the pleadings, UNICON asserts that the Award is fundamentally flawed, egregiously misapplies New York law, and is tainted by clear and blatant prejudice. It appears to have been rendered with the sole intent of protecting the World Bank’s interests, in complete disregard of both the law and the facts. The serious issues highlighted herein cast a profound shadow of doubt over the integrity of this arbitration and any future arbitrations involving the World Bank as a party. UNICON respectfully requests that the tribunal address these grave concerns and demonstrate that UNICON’s claims are unfounded by providing clear and unequivocal answers to the following questions, which should have been addressed in the Award but were not:

- Was it appropriate for the tribunal, under New York law, to allow the draftsman of the contract to deliberately withhold its interpretation of a material provision, at the crux of arbitration, namely Audit Limitation (ii), thereby obscuring the party’s intent?

- What precisely renders UNICON’s interpretation of the audit provision, as illustrated above, in ¶ 11, logically incomprehensible and unreasonable?

- Unless the tribunal can demonstrate that UNICON’s interpretation of Audit Limitation (ii) is absurd, in light of the World Bank’s own statements (see above), on what grounds did it deny UNICON all of its rights under New York law (see above)?

- If multiple reasonable interpretations of Audit Limitation (ii) were possible based on its language, what basis did the tribunal have for concluding that the provision was unambiguous? What justified the tribunal’s disregard of the cited provision in ¶ 32(i) above, considering the tribunal referenced this law in Award’s footnote 97 (CL-10)?

- Given the World Bank’s demand for both related and all other information (see ¶ 9), what justifies the tribunal’s position that it was wholly unreasonable to find such request in conflict with the language of Audit Limitation (ii)?

- Given that both parties to the arbitration agreed that (1) the term “other information” in Audit Limitation (ii) of Article 25.03 refers to any transaction appearing in the disputed bank statement but not related to the Contract, and (2) the World Bank’s access to unredacted bank statements would constitute a breach of contract, how did the tribunal integrate this agreed understanding into its analysis?

- To date, neither the World Bank nor the tribunal has provided their views on the interpretation and application of Audit Limitation (ii). What is the tribunal’s precise interpretation of each audit limitation, based on both facts and law?

- Given the tribunal’s reliance on the Vendor Eligibility Policy over explicit contractual provisions, what legal precedent supports the tribunal’s interpretation that such policies can override specific contractual terms? And what exactly in the Policy suggests its intention to override and supersede audit limitations in the contract?

35. These reasonable questions are fundamental in assessing the integrity and credibility of the Award in PCA Case No. 2023-69. The grounds for considering this a grave miscarriage of justice are not only substantial but also compellingly evident. If the tribunal members choose not to address these questions properly under any formal pretext, it will unequivocally affirm UNICON’s position: that the tribunal is unable to justify the Award that is fundamentally biased, legally unsound, and tainted by clear prejudice. Such an omission would irrefutably expose the tribunal’s inability to defend the integrity of its own decision, thereby confirming that the Award is inherently unreliable, improper, and devoid of legal credibility.

36. The ability of the World Bank to influence arbitral outcomes, directly or indirectly, raises significant and disturbing concerns regarding the impartiality and fairness of such proceedings. The decision in this case, which appears to be heavily biased in favour of the World Bank, disregards the principles of law and justice. This situation not only discredits this particular Award but also threatens the integrity of future arbitrations involving the World Bank. If the World Bank can leverage its influence to secure favourable outcomes, it erodes the fundamental principles of justice and equity that are supposed to underpin arbitration as a fair dispute resolution mechanism.

37. UNICON expects a credible response addressing all the questions above within 30 days, by September 9, 2024.

38. Failure to provide such a response will be considered a tacit admission of the tribunal’s inability to explain the basis of its Award, thereby affirming the accuracy of the statements made in ¶¶ 35-36 above.

Sincerely,

Rustam Davletkhan

Unicon Ltd / Claimant

_____________________

Media:

- Article by Global Arbitration Review

- Publication in Jus Mundi

_____________________

Unicon:

Arbitral Tribunal:

World Bank: